Blog

Can I Put IRA or Solo K Cash Under the Mattress?

As manager of the IRA LLC or the plan administrator of the Solo k, you have the ability to hold cash and it doesn’t have to be held at an institution.

How Can I Buy Real Estate in a Foreign Country with my IRA

https://www.youtube.com/watch?v=gmG_YHNWwbU

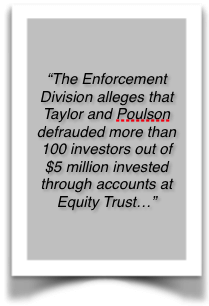

Equity Trust is Charged by SEC in Ponzi Scheme | Check Book IRA

Many of our Clients have come to us as refugees from Equity Trust and Sterling Trust. SEC Announces Charges Against Retirement Plan Custodian in Connection With Ponzi Scheme FOR IMMEDIATE RELEASE 2015-121 Washington D.C., June 16, 2015 —The Securities and Exchange...

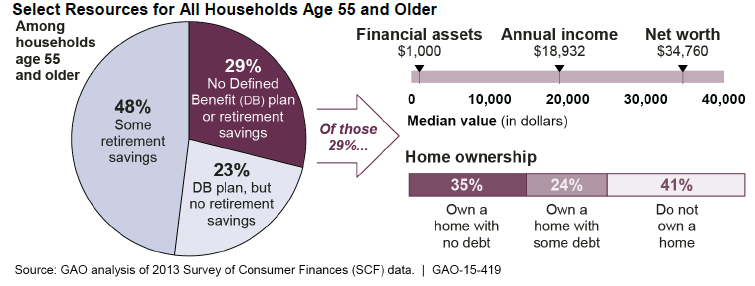

29% of Americans Have Zero Retirement Savings

This article from CNBC Shows more Americans Need our Services ! How bad is America doing when it comes to retirement savings? The Government Accountability Office looked into the question, and its answer is sobering. A new GAO analysis finds that among households with...

How much work can a Manager do on a property?

[1:37] Steve covers the principles of a manager of a Check Book IRA LLC or the plan administrator doing minor work on a property owned by their plan. There’s no hard fast rule but common sense needs to be used. Transcript Working On Your IRA-Owned Property Often...

Investor Tip #20 Making the Worst into the Best

Steve shares some insights from his investing experience.

A Cheap Dress up to a Real Estate Fixer Upper

Steve shares an inexpensive way to dress up and add value to a small fixer upper property.

Our NEW Solo 401(k) is Awesome!

Learn While on Hold

Learn While on Hold By Steve Sheppherd I’ve had multiple businesses in my day but learned something very valuable this morning. I thought I would pass it along for those of you that either have or are contemplating owning a business where customers would be calling...

Super Rich Rush to buy Gold

The super-rich are looking to protect their wealth through buying record numbers of "Italian job" style gold bars, according to bullion experts. The number of 12.5kg gold bars being bought by wealthy customers has increased 243pc so far this year, when compared to the...

Self Directed IRAs: Taking the Next Step

If are using a Self Directed IRA, then you are well aware of the benefits of retaining control of your investments. Most likely you are paying less, if anything, in advisor fees, transaction fees, annual fees, etc. You are able to invest in nontraditional assets...

Why File My LLC in New Mexico?

Many of our articles refer to filing your LLC in New Mexico rather than your home state. If you are wondering why, this article will help you consider the pros and cons of a New Mexico LLC. The number one reason our clients prefer to file in New Mexico is Privacy! ...

Annual Fees Overview: What Will My Check Book IRA Cost Per Year?

One of the most frequent questions I hear is, "What will this structure cost me annually?" Bascially, you may have two types of fees each year. Custodian fees (for the IRA) and State fees (for the LLC). Custodian Fees Our Custodian Our Qualified Custodian Company,...

Rolling Over Accounts to Your Check Book IRA: Problem Accounts

Rolling Over Accounts to Your Check Book IRA: Problem Accounts By Jordan Sheppherd When a prospective client calls us asking about the IRA LLC structure, I always start off by asking them what accounts they plan on moving over to the new structure. I ask this at the...

GenXer’s and the Savings Gap

According to an article by "The Street", about 85% of young adults say they would listen if their grandparents started a conversation about money management. Compare that to the measly 8% of grandparents surveyed who would actually discuss financial resources and you...

Annual Valuations: What You Need to Know

Each year, your IRA Custodian completes a Form 5498 and submits a copy to you as well as the IRS. The form reports your annual contributions to the IRA as well as amounts that were rolled over during the year.

Why Did I Get a 1099 for My Rollover?

So, six months ago, you finally decided to roll that old 401(k) from a previous job, into a self-directed IRA. You went online. You read articles. You even called your CPA to make sure the rollover was done correctly. You requested a direct rollover from your...

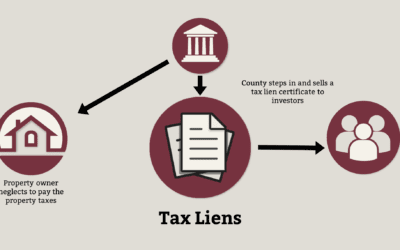

Tax Liens: Making it Work!

Tax Liens: Making it Work! By Jordan Sheppherd If you’ve read the “Tax Liens: Overview” article, you have a good sense of what a tax lien is and isn’t. Below, we discuss some of the ins and outs of tax lien investing. So although the highly publicized return rates of...

Tax Liens: An Overview

Tax Liens: An Overview By Jordan Sheppherd Clients often ask us, “Should I invest in tax liens? My brother-in-law says you can get 25% return!” Before discussing whether the investment is a right fit, it is best to make sure that the boundaries of what a tax lien is...

I Bought a Rental… Now What?

I Bought a Rental... Now What? This post will answer some of the common questions we get about how a piece of rental real estate would be handled in an IRA LLC. A lot of people get that an IRA LLC can buy property, but they sometimes have questions about how the nuts...

Can You Retire in a Home Purchased With Your IRA?

The short answer is yes. However, as with most retirement strategies, there is a little more involved.

You Can’t Do That! Prohibited Transactions 101

This is the first post in a new series we will be doing, entitled “You

Can’t Do That!” In this series, we will be examining transactions that would be considered prohibited under IRC 26.

Another World Bank

BRICS (a group composed of the leaders of Brazil, Russia, India, China and South Africa) has created a Shanghai based development bank; similar to a mini IMF (International Monetary Fund) and the Eastern Worlds answer to the Western World Bank. Plans were announced...

Fast-Tracking Funds to Your New IRA – Liquidating Your Assets

So you’re ready to start a Check Book IRA; you’ve done the research, you’ve found an investment you believe in, you’ve made the decision to take control of your retirement funds.