Blog

Baby Boomers Are Retiring Later In Life – A Few Things You Can Do To Ensure You Retire Sooner Than Later – Part 1

New data concerning those entering their golden years has recently emerged concerning retirement, and it's news that likely won't make that crowd happy. My New Financial Advisor, a financial advising company based out of California, has indicated that the majority of...

The NEW Definition of Retirement – The act of retiring to the thing that really excites you

Retirement has come to take on new meaning in recent years. Where it used to mean more time to sleep and doze on the porch with the pooch or to sit on a beach in Florida, now it’s more a time to indulge in the things that you’ve been wanting to do for years! It’s time...

5 Popular Investments for a Check Book IRA LLC

We’re often asked by current and prospective clients what other people are doing with their retirement money.

Tom Woods Smashes the Federal Reserve & Stands Up for Free Markets

http://www.youtube.com/watch?v=541bajR4k8g I'll be posting some economics related material in the next few weeks, and I can't think of a better place to start than with this lecture entitled "Meltdown" by Dr. Thomas E. Woods, Jr. Tom Woods is a New York Times...

Don’t Forget to Renew Your LLC (Like I Did)

For those of you who already have a CheckBook IRA, here’s a friendly reminder to renew the LLC. An LLC continues in existence only at the pleasure of the State in which it was created.

What Kind Of Exercises Should Seniors Be Doing?

Yesterday we established that one of the keys to a happy retirement was getting out and about, socializing, and most importantly fitting some kind of exercise into your weekly game plan. As we age, it gets increasingly difficult to maintain physical fitness – but that...

Who’s Got Your Back?

A large number of prospective clients in the last few months have mentioned how difficult it is to find someone who can adequately answer their questions regarding the CheckBook IRA structure. If they try to lay out a possible transaction, or ask for some guidance on how to structure a deal, all they get is a sales-pitch.

Having A Good Time And Exercise Are The Keys To A Happy Retirement

As you enter your golden years, it's important to remember the good things in life. More importantly, it's important that you spend some of your newly found free time having a good time. It may seem a bit obvious, but it's important to keep these kinds of things in...

How will a $1.1 Trillion Deficit affect your IRA?

Retirement Guy covers what the $1.1 Trillion dollar deficit can mean to your IRA Retirement account and how a Self Directed Checkbook IRA LLC can help protect your retirement account from inflation by investing in Gold and Silver American Eagles, and holding them at...

IRA LLCs & Tax Liens: Retirement Guy Explains

Retirement Guy talks about using a CheckBook IRA LLC to invest in tax liens. He reviews the reasons why using a self-directed IRA is nearly useless when it comes to tax lien investing, and explains how the process would work with an IRA LLC. Find out why a...

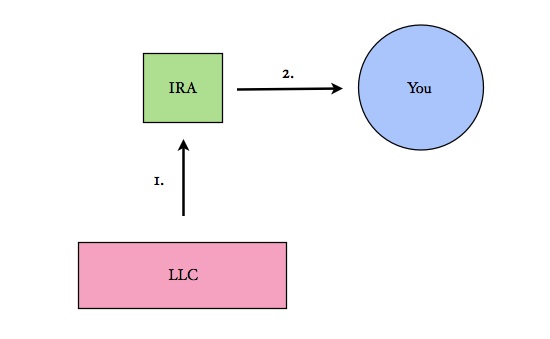

Making a Distribution with the CheckBook IRA LLC

The subject of this post fits squarely within the bounds of a Frequently Asked Question. If you have an IRA, you’re going to eventually make distributions. If you’re of a certain age, you may be making distributions now. The question here is, how do you make a distribution with the CheckBook IRA structure?

Retirement Guy Reviews CheckBook IRA

As a followup to our last post, here is a short video by Retirement Guy in which he explains the basics of the CheckBook IRA structure. Join the thousands who have freed themselves from costly Custodial fees and restrictions....

An Overview of the CheckBook IRA Structure

We’ll get to the CheckBook IRA LLC in a minute, but the first thing to address is IRAs. A lot of people still don’t know they can buy non-traditional investments with their IRAs; they don’t know they can buy things like real estate, or make hard-money loans with their...

IRS Filing Requirements for a CheckBook IRA LLC

IRS Filing Requirements for a CheckBook IRA LLC This post addresses tax filing requirements for CheckBook IRA structures that have one IRA and one LLC, which is to say single-member LLCs. We explain tax reporting for multi-member IRA LLCs in this post. Please also...

Tax Liens in an IRA LLC

I really want to take advantage of the massive profits to be made in tax liens but Iʼm having difficulty in doing so with my Self Directed IRA, can I do tax liens in an IRA LLC?

CheckBook IRA LLC: How much control do I get?

With an IRA LLC you get complete and total control of your retirement funds. If you only have a self-directed IRA, your funds would be held by the Custodian, and you would have to go through them for each and every transaction/investment. With a CheckBook IRA, your...

What is a Self-Directed IRA Custodian?

Substantially, a “self directed IRA Custodian” is no different than any other Custodian. An IRA is technically a trust, and any Custodian is technically the trustee of that trust.

IRA LLC & Rental Property: A Common Mistake

The lesson to be learned here is that, it can be easy to misstep with this kind of a structure if you don’t know the rules.

Prohibited Transaction Rules, Part IV: IRA LLC Examples

In Part I, we talked about prohibited transaction rules in general; in Part II, we talked about prohibited parties specifically; and in Part III, we talked about prohibited entities. Now that we've covered some ground, let's put it all together and look at some...

Prohibited Transaction Rules, Part III: Disqualified Entities

Prohibited Transaction Rules, Part III: Disqualified Entities By Jordan Sheppherd In Part I of this series we defined a prohibited transaction, and in Part II we looked at who the disqualified persons are to your CheckBook IRA LLC. Next, we’ll look at disqualified...

Prohibited Transaction Rules, Part II: Who is a prohibited person?

Prohibited Transaction Rules, Part II: Who is a prohibited person? By Jordan Sheppherd Part I of this series was all about defining what constitutes a prohibited transaction. You know that any deal or transaction of any kind between a plan and a prohibited person is...

Prohibited Transaction Rules, Part I: An IRA LLC Primer

Clients will often ask me what I think is the most important thing for them to learn before they have us set them up with a CheckBook IRA LLC. I always answer that the subject of prohibited transactions is by far the most important. It can sometimes seem a bit...

Can I retire in a house bought by my IRA LLC?

Most people are under the impression that a distribution from their IRA must be in cash.

How do I make a distribution from an IRA LLC?

One of the things that can hang people up when they are introduced to the CheckBook IRA LLC structure is how a distribution of funds would occur once they retire. Below is an excerpt from an email I received from one of our prospective clients: …how would I take...