One of the things that can hang people up when they are introduced to the CheckBook IRA LLC structure is how a distribution of funds would occur once they retire. Below is an excerpt from an email I received from one of our prospective clients:

…how would I take money out of the IRA LLC once I retire? Would I just write myself a check? Or would I have to send the money back to the Custodian, and then take a distribution?

My reply in part:

Dear Angela,

…

You’re on the right track about sending funds from the LLC back to the Custodian. Technically the LLC would not distribute the funds to you, your IRA would make the distribution. Remember that the LLC is a private company and is simply an asset of the IRA. Any distribution made to you must come from the IRA itself, so the first step would be to either send a check or a bank wire from the LLC’s bank account to the Custodian of record.

The Custodian would deposit the funds into your IRA, and then you could request a distribution from that Custodian. They would process the request, send you a check for the distribution amount, and 1099 you for that amount. You would declare that distribution amount as taxable income for the year in which the distribution was made, and would have to pay taxes on it…

Jordan

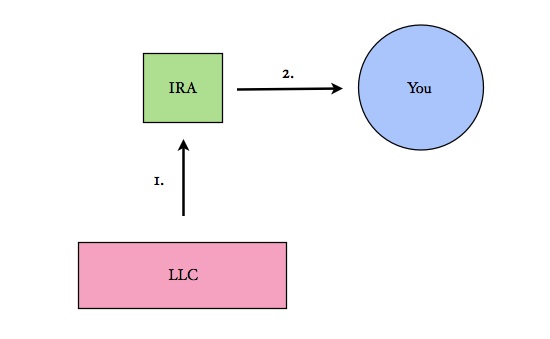

Here is a chart to help illustrate the process.

- First, the LLC would distribute funds back to it’s owner (the IRA).

- Once the funds are in the IRA, you would apply to the Custodian for a distribution. The Custodian would send a check payable to you as a distribution from the IRA.

Invest intelligently. Enjoy the rewards.

![]()

Jordan Sheppherd | Owner and Founder

Email: [email protected]

Phone: 1-800-482-2760

Redmond OR | Scottsdale AZ | Minneapolis MN

Does the Custodian hold out tax when a distribution is made?

Thanks for the question, Eve.

Typically Custodians will not hold out any tax when a distribution is made. Most Custodians will process the distribution, and then issue a 1099 to you for the distribution amount. The Custodian we work with does not withhold anything when a distribution is made.

Why could you just make a distribution from the LLC and then tell the Custodian you made the distribution? Since the IRA owns the whole thing, it doesn’t make sense you couldn’t just take it from the LLC.